Stockwatch: a rocky road to recovery as big day looms for this pair

As we discover what a “new normal” means, our companies analyst thinks this theme could be one to play.

29th May 2020 12:02

by Edmond Jackson from interactive investor

Share on

As we discover what a “new normal” means, our companies analyst thinks this theme could be one to play.

Stocks such as Pendragon (LSE:PDG) and Motorpoint (LSE:MOTR) are rising, but, with car showrooms open from Monday 1 June, does this represent chiefly “thematic buying” off March/April lows, or a genuine prospect of value?

Before the coronavirus, the stories surrounding motor dealers had already been challenged: an uncertain Brexit trade outcome affecting both demand and potentially price/ability to import from the EU.

So, revenue growth is elusive, lease and debt costs are weighing (for Pendragon) and there is excess used stock. The broad sense was that growth in sales had become dependent on finance schemes - an unstainable bubble – and, coincidentally, people may be reluctant to replace their vehicle until electric becomes better established. Maybe I am like many: the existing petrol car runs fine, so why not bide my time until electric is sorted?

A near-essential industry about to enjoy a fillip?

The prospect of public transport being a hassle for social distancing, and later risk of being instructed to self-isolate (should you be running the NHS app) is likely to fuel short-term demand at least, for used cars. That should help the market re-balance to the benefit of Motorpoint, which specialises in used vehicles under two years old and 15,000 miles clocked, and also Pendragon, which though spread across new cars and leasing, had been showing good progress with a turnaround and has a calibre new CEO.

But the five-year financial tables show these businesses trade on low single-digit margins at the best of times, hence their equity is vulnerable to any kind of disruption causing a recession.

Yet people do still need cars; the environmentalists’ crusade is a long way from victory.

While car sales plunged 97% in April, the stock market is enjoying better times. This week, Pendragon had nearly doubled from its mid-March low of 5p to 9.5p, as enough traders embraced “risk-on” as they did with airline stocks.

Lease liabilities and debt do weigh, but the chief reason for single-digit penny status is the nearly 1.4 billion shares in issue. I suspect this will eventually get fixed by way of a share consolidation.

Source: TradingView. Past performance is not a guide to future performance.

New CEO is a notable catalyst for Pendragon

Bill Berman was previously president and chief operating officer of AutoNation, the largest car retailer in the US. He was initially appointed a non-executive director at Pendragon in April 2019, becoming interim executive chairman last October, then CEO in February, so is familiar with the business.

While helpful to have a capable US perspective, sales in the States constituted only 9% of Pendragon’s 2019 revenue (falling 12% to £422.3 million equivalent, based on new vehicle sales of £305.9 million and used of £75.7 million).

So, we’re not looking at a risky managerial balancing act, although, as countries, the UK and US have much to prove – whether their virus-testing and track-and-trace can mitigate re-infections or if lockdown 2.0 follows.

Yet, it is fundamentally attractive how a capable boss has taken the reigns just as Pendragon was showing a definite upswing. The first quarter of 2020 saw an underlying loss of £2.3 million despite a circa £10 million lockdown impact, versus a like-for-like underlying loss of £2.8 million.

Obviously, the question ahead is what will be the “new normal” for trading after April/May’s lockdown.

Also, it doesn’t appear that a radically different Pendragon will emerge, despite Berman promising a fuller update on strategy later this year. It will still constitute new and used vehicles and leasing.

Moreover, Brexit trade risks are intensifying and it is unclear whether both sides will ultimately compromise. New vehicles are sourced chiefly from the EU, so there is a particular risk.

Logistics issues also conflate with a hard Brexit’s demand shock to the UK economy which also combines with the virus, which might worsen again this winter.

- Ian Cowie: tomorrow’s big winners in Asia

- Global markets: the best and worst recoveries

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Offsetting these uncertainties in the short term however, Pendragon has said it has modelled for a severe reduction in vehicle sales and was comfortable regarding bank covenants and facility limits.

So you can perhaps see why the stock has been bought off its lows – assuming no second lockdown.

More positively, on 24 April a non-executive director bought 250,000 shares at 7.25p, and yesterday a Holdings RNS announcement cited Odey Asset Management raising its stake from 15% to 16.2%.

That implies a conviction holding, as it would be tricky to cut if things went awry, although Crispin Odey is a known flamboyant.

Weak balance sheet and cash flow record

Both a weak balance sheet and cash flow record have accentuated the effects of Pendragon’s profit/loss narrative. 2019 was a story of two halves: first an underling loss of £32.2 million as old stock was cleared, then a second-half underlying profit of £15.8 million.

Although it is hardly surprising that the annual results don’t highlight the second-half 0.008% underlying operating margin on £2,050 million revenue which that implies. That’s against an overall £117.4 million after-tax loss for 2019. There was no final dividend after the interim was also passed.

A performance re-set was helped by closing 22 under-performing “car store” locations, better management of used vehicle inventory, and a focus on costs. Such reforms are said to put the business on a much stronger footing.

Yet the table below shows persistently negative free cash flow, which needs to reform for the stock to be anywhere near investment grade. Pendragon’s end-2019 balance sheet had net assets of £168.9 million, or 12.4p a share, albeit with goodwill/intangibles constituting 102%.

My classic bugbear of working capital – a chronic imbalance of trade debtors versus trade creditors – is extreme here: £1,085 million versus £107 million. Working capital set-ups can vary, but I tend to fret about any culture of late payments supporting profit.

Year-end-cash rose 8% to £55.7 million for net debt of £119.7 million, all long-term, although there is a total £261.7 million of lease liabilities. Hence an underling operating profit of £14.0 million on continuing operations was wiped out by £26.8 million net interest paid.

Frankly, the balance sheet puts Pendragon off-limits to genuine investors, but, after its stock has taken a long fall, there’s a capable new CEO, used car demand could perk up and “risk” is being bought, so this stock can continue to recover if lockdown-easing works. For well-capitalised risk-lovers: currently at 9p, Buy.

| Pendragon - financial summary | ||||||

|---|---|---|---|---|---|---|

| Year ending 31 Dec | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover (£ million) | 4,000 | 4,454 | 4,537 | 4,324 | 4,149 | 4,084 |

| Operating margin (%) | 2.4 | 2.7 | 2.2 | 1.8 | -0.7 | -2.8 |

| Operating profit (£m) | 97.2 | 122 | 100 | 77.9 | -27.3 | -115 |

| Net profit (£m) | 49.8 | 72.9 | 55.5 | 53.3 | -50.5 | -117 |

| Normalised earnings/share (p) | 3.5 | 5.2 | 4.0 | 3.0 | 2.7 | -1.4 |

| Operating cashflow/share (p) | 4.8 | 5.1 | 4.1 | 6.5 | 3.7 | 2.4 |

| Capex/share (p) | 6.6 | 9.4 | 10.1 | 13.5 | 9.5 | 8.3 |

| Free cashflow/share (p) | -1.8 | -4.3 | -6.0 | -7.0 | -5.8 | -5.9 |

| Dividend per share (p) | 0.9 | 1.3 | 1.5 | 1.6 | 1.5 | 0.0 |

| Covered by earnings (x) | 3.8 | 3.8 | 2.6 | 2.2 | -2.7 | |

| Cash (£m) | 91.4 | 139 | 84.0 | 53.3 | 51.4 | 55.7 |

| Net debt (£m) | 109 | 79.6 | 91.7 | 124 | 128 | 381 |

| Net assets (£m) | 340 | 395 | 373 | 425 | 346 | 169 |

| Source: historic Company REFS and company accounts |

Motorpoint offers a logical diversification

If tempted by this overall theme - that motor dealers can thrive by renewed demand for quality used cars especially - one’s risk may be intelligently split to include this £204 million small-cap, which is the UK’s largest independent vehicle retailer, with just over £1 billion annual revenue.

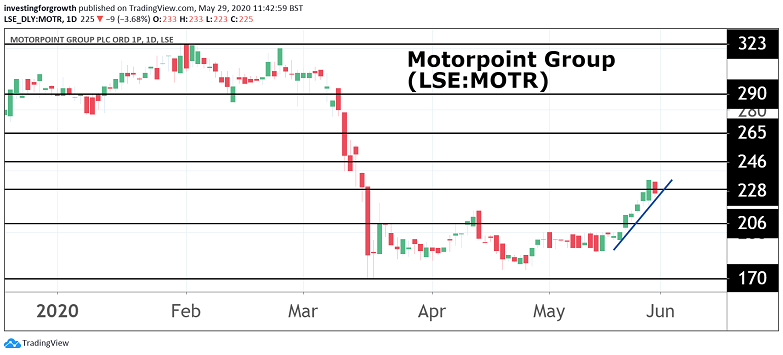

Floated exactly four years ago, it has a better (if still volatile) long-term chart than Pendragon’s chronic decline, based on a focused business model: selling cars up to two years-old that have done up to 15,000 miles, from 13 branches.

Mind, the last results did not inspire. The six months to 30 September 2019 showed pre-tax profit down 18% to £9.4 million due to higher overheads, half of which were non-recurring. Revenue of £533.9 million was near-flat, said due to a challenging environment and with talk of being second-half weighted “however potential outcomes from the government’s Brexit negotiations could influence our future performance in unpredictable ways.”

Source: TradingView. Past performance is not a guide to future performance.

More positively,

“our unrivalled choice of nearly new vehicles…positions us strongly to take advantages of any market disruption, as evidenced in the period by our growing market share.”

Cash flow conversion of profit was very strong, and the interim dividend edged up 4% to 2.6p.

So, Motorpoint’s marketing positions it well for an upturn in used car demand as consumers adjust behaviourally to the declining pandemic, and also to what they can afford.

The end-September 2019 balance sheet was debt-free, also of goodwill/intangibles, albeit with £45.5 million overall lease liabilities in context of £14.4 million net assets, including £10.3 million cash.

I still raise an eyebrow at £92.1 million trade payables versus £8.1 million trade receivables, but at least the imbalance is pretty constant (whereas a change can boost profit). Finance costs took 15% of £11.1 million interim operating profit.

| Motorpoint - financial summary | ||||||

|---|---|---|---|---|---|---|

| Year ending 31 Mar | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover (£ million) | 473 | 563 | 729 | 822 | 991 | 1,059 |

| Operating margin (%) | 1.6 | 1.7 | 2.4 | 1.6 | 2.2 | 2.4 |

| Operating profit (£m) | 7.5 | 9.4 | 17.3 | 12.9 | 21.3 | 25.5 |

| Net profit (£m) | 5.9 | 7.4 | 13.4 | 8.7 | 16.0 | 17.7 |

| Normalised earnings/share (p) | 5.9 | 6.5 | 12.4 | 5.7 | 15.3 | 18.0 |

| Operating cashflow/share (p) | 6.9 | 3.4 | 14.2 | 3.2 | 14.9 | 21.3 |

| Capex/share (p) | 0.8 | 2.5 | 1.3 | 6.9 | 1.3 | 4.3 |

| Free cashflow/share (p) | 6.1 | 0.9 | 12.9 | -3.7 | 13.6 | 17.0 |

| Dividend per share (p) | 4.2 | 6.6 | 7.5 | |||

| Covered by earnings (x) | 2.1 | 2.4 | 2.4 | |||

| Cash (£m) | 5.1 | 3.6 | 11.6 | 7.3 | 15.6 | 13.8 |

| Net debt (£m) | 24.9 | 33.4 | 39.4 | 57.6 | 53.4 | 115 |

| Net assets (£m) | 17.4 | 24.8 | 25.7 | 14.7 | 26.4 | 26.0 |

| Source: historic Company REFS and company accounts |

As with Pendragon, it is a speculation to assume car sales will flourish, but, if we are indeed looking back on lockdown and a new era of contending coronavirus beckons, it is a fair bet. On such a rationale, the stock merits consideration versus Pendragon or to use as diversification. So, at 232p, Buy.

Please do bear in mind that if global risk sentiment shifts adversely again, these and other “re-opening” plays will be hit. But if the broad trend is, as one GP claimed to me last weekend, “we are seeing viral symptoms abating hence a second wave: yes, but less serious,” then motor dealers and the like are on a rocky road to recovery.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.